The ManpowerGroup Employment Outlook Survey for the first quarter 2021 was conducted by interviewing a representative sample of 1,306 employers in the UK.

All survey participants were asked, “How do you anticipate total employment at your location to change in the three months to the end of March 2021 as compared to the current quarter?”

Interviewing was carried out during the exceptional circumstances of the COVID-19 outbreak. The survey findings for the first quarter of 2021 are likely to reflect the impact of the global health emergency, and may be notably different to previous quarters.

The survey results for this quarter report that:

UK employment Outlook least positive in Europe

Optimism returns in vital finance and business services sector

Exodus of EU workers creates opportunity for UK workforce but skills shortagesloom in key sectors like Construction

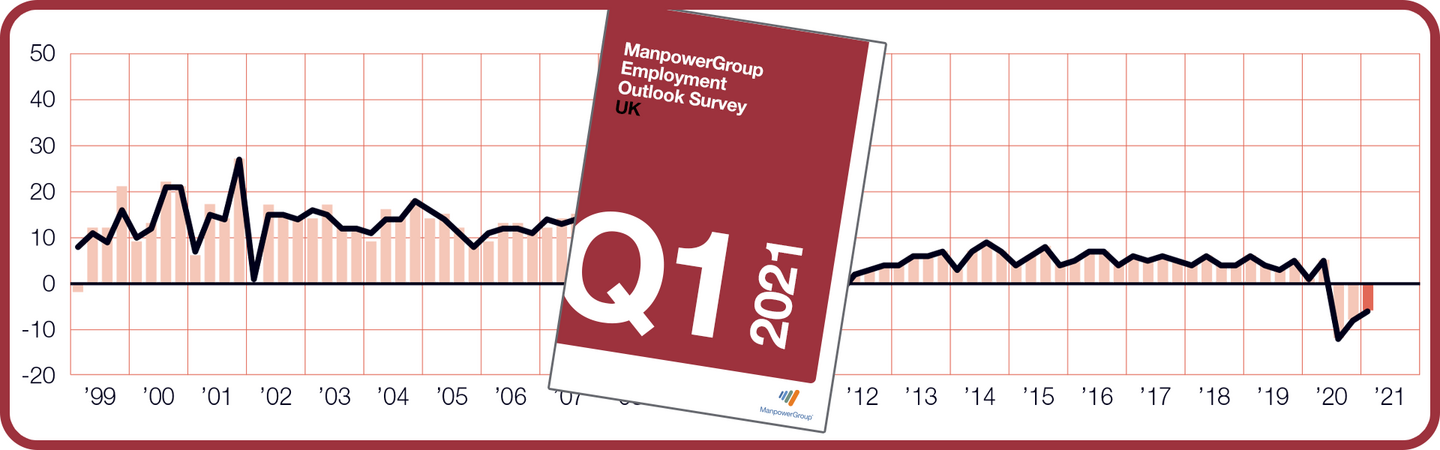

The UK jobs Outlook has rebounded six points in the last six months to -6%, according to the latest ManpowerGroup Employment Outlook Survey, but the picture is disappointing compared to the rest of Europe and the labour market is increasingly divided. Sharp improvements in finance and business services and construction are offset by new falls in retail and hospitality, while the outlook in London has hit an all-time low.

Mark Cahill, Managing Director, ManpowerGroup UK says: “The headline numbers are steadily moving in the right direction, and we are seeing a continued resurgence in key sectors like finance and business giving us reasons to be cheerful as we head into 2021. However, despite this positive trajectory, the UK remains the least optimistic in Europe, with continued uncertainty over Brexit and the effects of a second COVID-19 wave still looming large. Looking further ahead, our data also shows that only 49% of employers expect their hiring to return to pre-pandemic levels within the next 12 months.”

Retail and hospitality is down two points to -13%, the weakest on record. Cahill continues: “The further decline of Britain’s high streets is deeply concerning. Shops, restaurants, and bars have remained mostly shut across the country, and the young people who make up a large proportion of workers in this sector have often borne the brunt. Stalwarts like Pret a Manger and TM Lewin are closing their doors as demand for quick lunches, smart shirts and suits has dried up, while Caffe Nero is on the brink of insolvency.”

ManpowerGroup Employment Outlook Survey Report